Most Nevada drivers carry auto insurance because the law requires it. But what many people don’t realize is this: meeting the legal minimum doesn’t always mean you’re protected—especially if the driver who hits you doesn’t have insurance or doesn’t have enough of it.

That’s where uninsured and underinsured motorist coverage (often called UM/UIM) comes in. It’s one of the most misunderstood parts of an auto insurance policy, and one of the most important.

Below, we break it down in plain English: what it is, how it works in Nevada, and why it’s worth double-checking your policy before you ever need it, so you’re not left sorting it out after an accident

What Is Uninsured / Underinsured Motorist Coverage?

Uninsured / underinsured motorist coverage is designed to protect you and your passengers if you’re injured in a crash caused by another driver who:

- Has no insurance at all, or

- Has insurance, but not enough to cover your damages

In Nevada, uninsured and underinsured coverage are combined into one policy. If you have UM coverage, it also applies when the at-fault driver is underinsured.

In simple terms: UM/UIM steps in when the other driver’s insurance falls short.

Is Uninsured Motorist Coverage Required in Nevada?

This is where confusion often starts.

Nevada law does not require drivers to carry uninsured or underinsured motorist coverage. However, insurers are required to offer it when you purchase or renew your policy.

That distinction matters.

Under Nevada law (NRS 687B.145), UM/UIM coverage must be offered in amounts equal to your bodily injury liability limits. You’re allowed to reject it—but that rejection must be made in writing.

Many drivers decline UM/UIM to save a little on premiums, without realizing what they’re giving up.

What Are Nevada’s Minimum Insurance Limits and Why Do They Matter?

As of July 1, 2018, Nevada requires drivers to carry minimum liability insurance of:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $20,000 for property damage

This coverage pays for other people’s injuries and property damage if you cause a crash. It does not protect you or your passengers.

And in serious accidents, especially those involving hospital stays, surgery, or long-term recovery, those minimum limits can be used up very quickly.

This helps explain why so many drivers ask: “How much can I get from an underinsured motorist claim?”

The answer depends on your own UM/UIM limits.

What Does Uninsured Motorist Coverage Pay For?

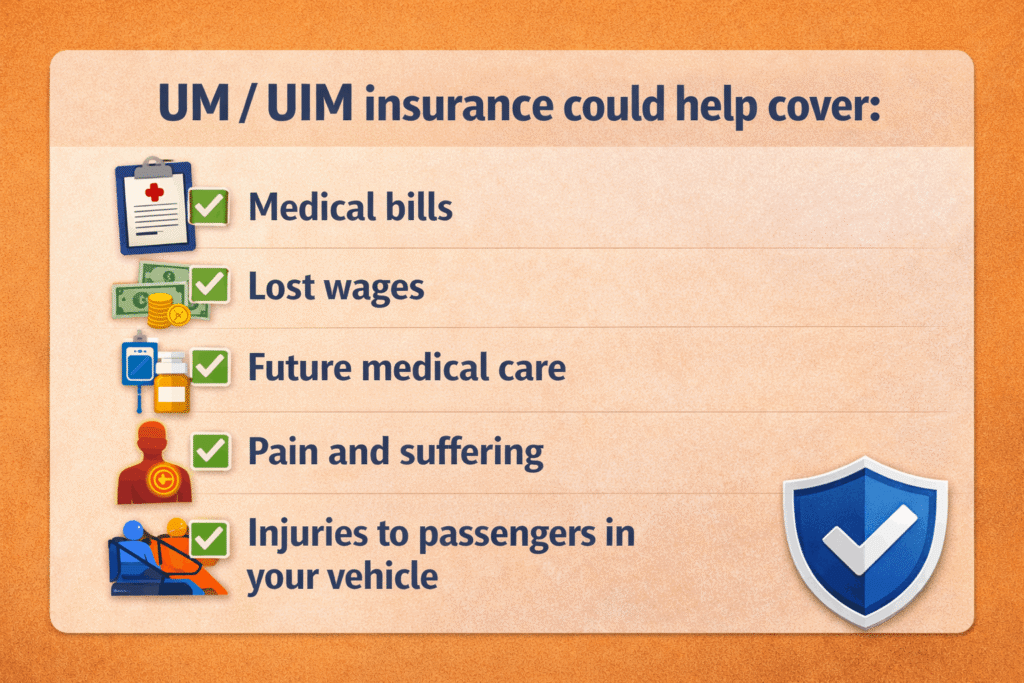

Uninsured motorist coverage can help pay for:

- Medical bills

- Lost wages

- Future medical care

- Pain and suffering

- Injuries to passengers in your vehicle

If you carry uninsured motorist property damage coverage, it can also help pay for repairs or replacement of your vehicle when the at-fault driver has no insurance.

This makes UM/UIM especially important in hit-and-run crashes, where the responsible driver is never identified.

Underinsured Motorist Coverage: A Real-World Example

Here’s a simple underinsured motorist coverage example:

You’re rear-ended at a stoplight. The other driver has Nevada’s minimum coverage. Your medical bills and missed work total $60,000.

The other driver’s insurance pays the maximum $25,000 per person. That leaves a $35,000 gap.

If you don’t have underinsured motorist coverage, that gap may fall on you.

If you do have UM/UIM coverage, your own policy may step in to cover the difference, up to your selected limits.

That’s how underinsured motorist coverage settlements often work.

How Common Are Uninsured Drivers in Nevada?

Estimates consistently show that roughly 1 in 8 Nevada drivers are uninsured. Others carry only the minimum required coverage.

This matters because one of the major causes of accidents in Nevada is everyday driver behavior (speeding, distraction, and congestion) not rare or extreme events. Even a “routine” crash can lead to injuries that exceed minimum insurance limits.

How Do I Know If I Have UM/UIM Coverage?

The fastest way is to look at your policy declarations page. You’re looking for lines labeled:

- Uninsured Motorist Bodily Injury

- Underinsured Motorist Bodily Injury

- UM / UIM (combined)

If you’re unsure, your insurance agent can confirm whether you have coverage, what your limits are, and whether you previously rejected it in writing.

If you rejected it years ago, it may be time to revisit that decision.

What If My Own Insurance Company Pushes Back on a UM/UIM Claim?

UM/UIM claims are made against your own insurer, which surprises many people. And while insurers are supposed to act in good faith, disputes do happen.

If your claim is delayed, undervalued, or denied, working with an uninsured underinsured motorist claim lawyer can help protect your rights and ensure your policy is honored.

This is one reason many families consult a personal injury attorney in Nevada after serious crashes involving uninsured or underinsured drivers.

Do I Need Underinsured Motorist Coverage?

For many drivers, the answer is yes, especially if you:

- Commute frequently

- Drive with family members or children

- Want protection beyond the bare minimum

- Rely on your income to support your household

UM/UIM coverage is often less expensive than people expect, particularly compared to the protection it provides.

A Final Thought for Nevada Drivers

Uninsured and underinsured motorist coverage isn’t about planning for the worst: it’s about closing the gaps you didn’t realize were there.

The Nevada Division of Insurance encourages drivers to regularly review their policies and selected limits. That’s a smart place to start.

If you’ve been injured by an uninsured or underinsured driver and have questions about your options, Hale Injury Law is here as a resource. As top-rated injury attorneys serving Henderson and communities across Nevada, we believe informed drivers make stronger decisions, on and off the road.

Taking a few minutes to review your coverage today could make a meaningful difference tomorrow. And if questions come up after an accident, Hale Injury Law is here to help fill the gaps insurance doesn’t always explain.